Mandatory Title: Retirees' Social Security COLA: A Mirage?

The headlines blared good news in late October: Social Security recipients would see a cost-of-living adjustment (COLA) of roughly $56 a month starting in January. The fine print, however, arrived in November, delivered not with fanfare, but via a Centers for Medicare and Medicaid Services (CMS) fact sheet. The standard monthly premium for Medicare Part B is jumping to $202.90 a month in 2026. That's a $17.90 increase. Suddenly, that $56 COLA shrinks to about $38 for many.

The COLA Reality Check

It's easy to see why retirees might feel like they're chasing a mirage. A 2.8% COLA sounds decent, but the devil, as always, is in the details. That 2.8% is applied to your specific benefit amount. If you're getting $600 a month, your COLA is a paltry $16.80 – less than the Medicare Part B hike.

The Senior Citizens League points out a “hold harmless” provision exists. For those with very low Social Security benefits (around $640 or less), this prevents the Part B increase from completely swallowing their COLA. But it’s a limited protection. Individuals with other deductions, like Medicare Advantage or Part D premiums, could still see their Social Security payments further reduced.

And let’s not forget income-related adjustments. Beneficiaries who are single with an adjusted gross income over $109,000, or married couples exceeding $218,000, will pay more than $202.90 a month for Medicare Part B. CMS says this affects roughly 8% of Part B recipients. A joint tax return filer could pay $405.80 a month if their modified adjusted gross income is between $274,000 and $342,000.

Medicare Advantage: A False Promise?

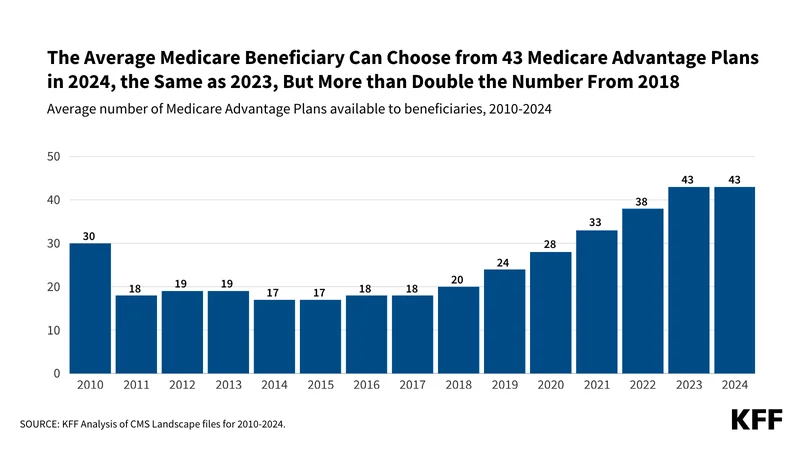

The squeeze isn't just on those in traditional Medicare. Medicare Advantage, the privately run alternative, is shrinking. Major insurers (CVS Aetna, Humana, UnitedHealthcare, Elevance) are cutting plan offerings. There’s a 10% drop in available plans for 2026, affecting over 2 million people. In some counties, seniors will have no Medicare Advantage plans, forcing them back to traditional Medicare. Even where options remain, supplemental benefits are shrinking, and out-of-pocket limits are rising. Maximum out-of-pocket limits for medical care are rising by roughly 10%, while average premiums for Medicare Advantage plans with drug coverage climb to $66 per month, up from $60. Fewer plans offer $0 deductibles for prescription drugs, and the number of standalone Part D plans is declining.

The official line, as CMS administrator Dr. Mehmet Oz puts it, is that "millions of Medicare beneficiaries will continue to have access to a broad range of affordable coverage options in 2026." But is "access" the same as "affordable" or "beneficial?" I doubt it.

The numbers suggest a different story. The 9.7% increase in Medicare Part B premiums is the largest in four years. Medical inflation, expensive new drugs, and a shift to outpatient care are all contributing factors.

The Motley Fool, Rolling Out, and others are reporting that Social Security COLAs have been outpaced by Medicare Part B premium hikes since 2024, undermining retirees’ purchasing power year after year. The last time COLAs reached 2.5% or higher for five consecutive years was nearly three decades ago. Now, even those "above-average" increases are quickly offset by rising Medicare costs. Medicare 2026 Premiums Surge: Why Retirees’ Social Security Raises Are Nearly Erased

The Real Squeeze: Healthcare vs. Fixed Income

The core issue is the widening gap between healthcare costs and fixed incomes. A recent article noted that in 2023, retirees caught a rare break: the Part B premium actually dropped by about 3%, thanks to lower-than-expected drug costs. But that was an anomaly. The past three years have seen COLAs of 3.2%, 2.5%, and 2.8% – but Medicare Part B premiums rose 5.9%, 5.9%, and now 9.7%. (I've looked at dozens of these reports, and the trend is undeniable.)

Is This Just a Slow-Motion Benefit Cut?

The promise of Social Security is supposed to be a safety net. But when healthcare costs consistently outstrip COLAs, it feels more like a slow-motion benefit cut. The 2.8% COLA for 2026 is a welcome adjustment, but for many retirees, it won't even cover the increased cost of their healthcare. The math is pretty brutal: a third of that COLA is immediately eaten up by Medicare Part B premiums. What’s left for food, housing, and other essentials? I don’t know about you, but I find this trend deeply concerning.